News & Insights

Simplifying the Complexities of Governmental Financial Statements

July 14th, 2021

|

Financial Statement & Audit Preparation

Every year it seems that financial statements are getting longer and more complicated due to new implementations and pronouncements by GASB (Governmental Accounting Standards Board). As a result, knowing the flow of the financials and what is included is getting more difficult every year. To help you understand and simplify the complexities of government financial statements below, let’s look at what makes up the reporting entity and dive into the various kinds of funds included.

What entities are included in the financial statements? The financial reporting entity is broken down into the primary government and component units.

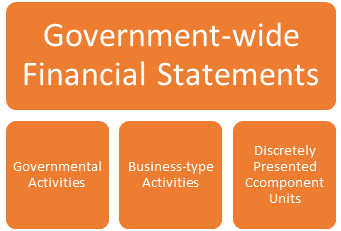

The primary government consists of all funds, organizations, institutions, agencies, departments, and offices that make up the legal entity. The primary government includes all governmental funds/activities and proprietary funds/business-type activities. The other portion of the financial reporting entity is the component units. Component units are organizations for which the primary government is financially accountable (fiscally dependent and financial benefit/burden). Therefore, an omission of the organization from the primary government financial statements would be misleading for the reader. If an entity is considered a component unit of the primary government, the financials are presented as part of the full accrual statements of the government. A component unit can either be discretely presented (shown as its own column) or blended with the primary government (shown as a fund).

Why are there so many funds? In governmental finical statements, each fund can be thought of as its own separate business. There is no specific number of funds that a government should use. A government should establish and maintain funds required by law and for sound financial administration.

What are the different types of funds?

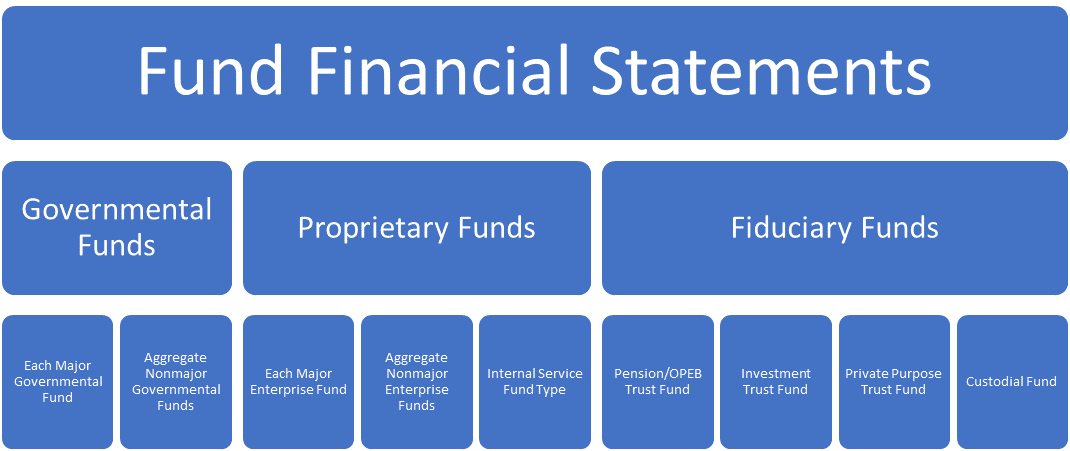

Governmental Funds: activities normally associated with governments, have a budgetary focus, and have a measurement focus with a current financial resource (modified accrual basis of accounting). Types of governmental funds are general, special revenue, capital projects, debt service, and permanent.

Proprietary Funds (business-type): operate similar to businesses with an objective to recover costs through fees charged. The Basis of accounting is full accrual which differs from governmental funds. Funds include items on the balance sheet such as capital assets and long-term obligations that governmental funds do not include as they are on a short-term basis.

Fiduciary Funds: Funds for resources held in a trust or custodial capacity. Like propriety funds, the basis of accounting is full accrual.

Utilizing the knowledge of an expert, trusted advisor will help simplify the complexities of the governmental financial statements and allow the user to harness the information and turn it into a usable resource for decision making. Contact us with any questions. We can help.