News & Insights

GASB 101 Calculation: Understanding Inflows, Outflows, and Compensated Absences

March 27th, 2025

|

Audit |

Audit & Assurance |

Education

GASB Statement No. 101, Compensated Absences, requires that liabilities for compensated absences be recognized for (1) leave that has not been used, and (2) leave that has been used but not yet paid in cash or settled through noncash means.

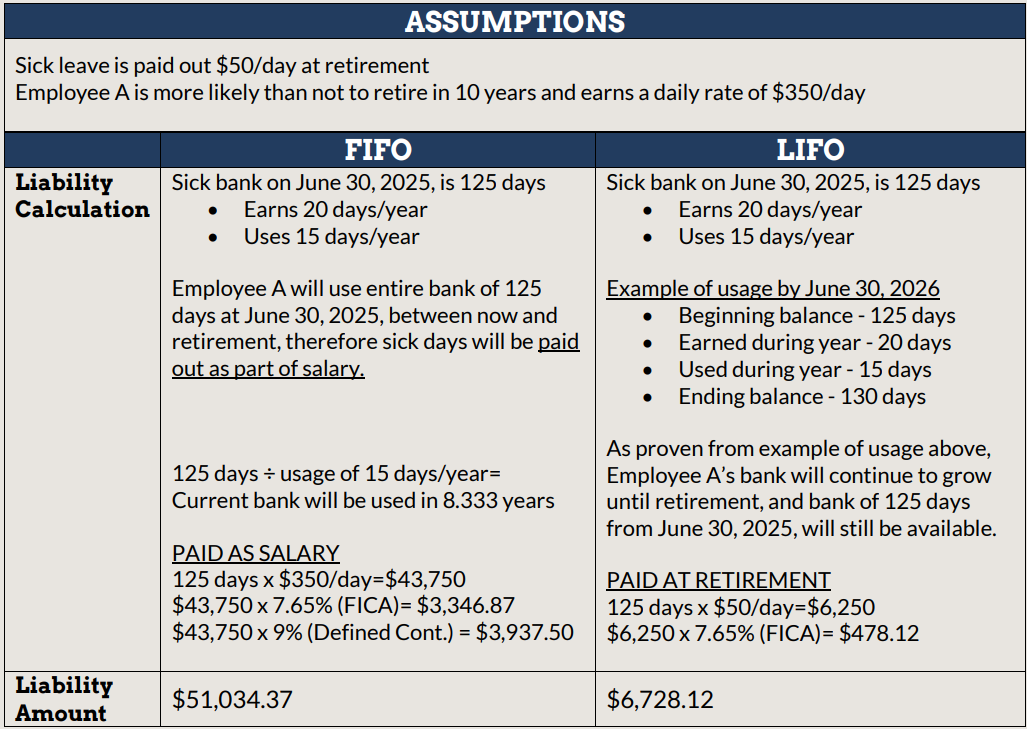

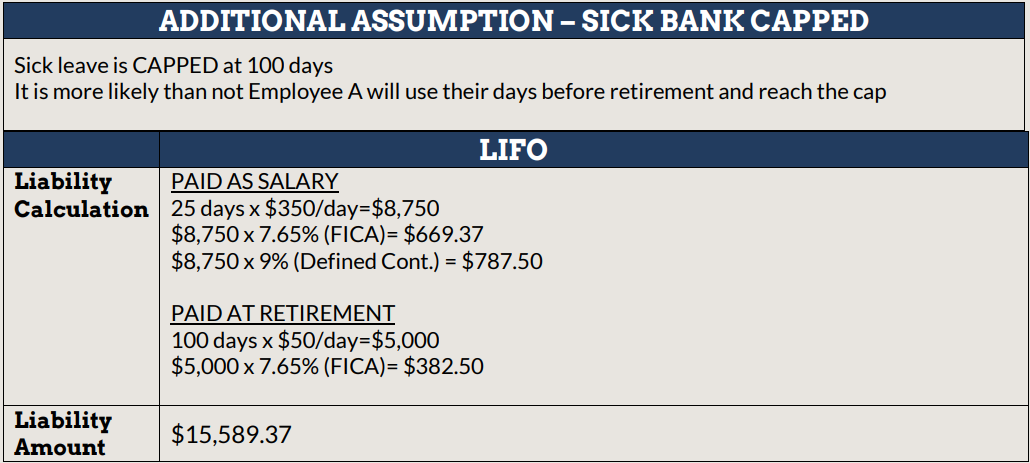

A liability should be recognized for leave that has not been used if (a) the leave is attributable to services already rendered, (b) the leave accumulates, and (c) the leave is more likely than not to be used for time off or otherwise paid in cash or settled through noncash means. This Statement also establishes guidance for measuring a liability for leave that has not been used, generally using an employee’s pay rate as of the date of the financial statements.

A key distinction from previous guidance is the shift from ‘termination payments,’ particularly evident in the treatment of sick leave accounting under GASB 101, which aligns sick leave calculations with other compensated absences rather than providing separate options for accounting, as seen in GASB 16.

A key component in determining the estimate of the amount due within one year is the flows assumption for the pattern of usage of compensated absences. The flows assumption, whether implicit or explicit, is used in determining whether the amount the district expects to pay in the next reporting period will be attributed first to (a) the recognized liability at the date of the financial statements (a first-in, first-out [FIFO] flows assumption) or (b) the leave earned in the next reporting period (a last-in, first-out [LIFO] flows assumption).

For more questions about GASB 101, contact the education audit experts at maner@manercpa.com or give us a call at 517.323.7500.