News & Insights

Michigan Cannabis Tax Update 2025: What Operators Need to Know About the New Wholesale Marijuana Tax

October 3rd, 2025

|

By Maddy Henry |

Business Tax Services |

Tax |

Cannabis

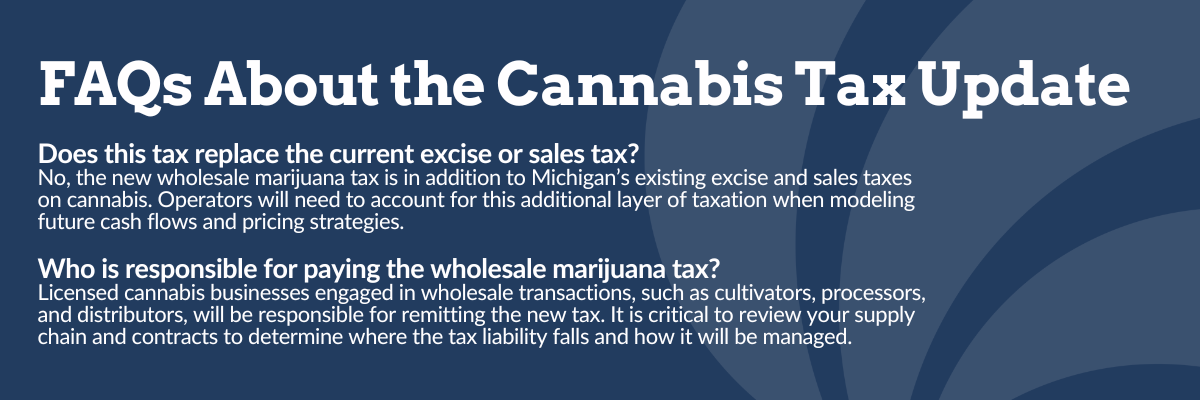

Michigan lawmakers recently approved the state’s new $81 billion budget for 2025–26, and included in it is a major change for cannabis operators: a new 24% wholesale marijuana tax. This cannabis tax is projected to raise more than $420 million annually, most of which will go toward long-term road funding across the state.

If you’re a cannabis operator in Michigan, here’s what this new marijuana tax means — and how to prepare for it.

Michigan Cannabis Tax Update: What’s Changing?

Beginning in January 2026, licensed cannabis businesses in Michigan will be required to pay a 24% wholesale tax in addition to the existing excise and sales taxes. This tax is designed to fund Michigan’s infrastructure improvements, contributing more than $1.8 billion annually for state and local roads by 2030.

How the New Marijuana Tax Impacts Cannabis Companies

For cannabis businesses, this update will have significant financial implications:

- Margin Compression: Operators will see tighter profit margins as costs rise.

- Pricing Pressure: Passing the tax along to consumers could push some buyers back to the illicit market.

- Competitive Strain: Smaller cannabis companies may struggle more than larger operators with deeper capital reserves.

- Market Risk: Out-of-state customers may think twice about purchasing in Michigan due to higher costs.

Cannabis industry advocates have warned this tax could unintentionally weaken the regulated market, making it even more important for licensed operators to be proactive.

Preparing for Michigan’s Cannabis Tax Changes

So, what should cannabis companies do next? Here are some steps to consider:

- Run the Numbers: Model how the wholesale marijuana tax will affect your margins, cash flow, and pricing.

- Scenario Planning: Test different pricing strategies to see what the market can handle without losing customers.

- Operational Efficiencies: Tighten up systems and look for ways to offset increased costs.

- Communications: Be prepared to explain the financial impact — and your plan — to investors, boards, and key partners.

How Maner Costerisan Can Help Cannabis Operators

At Maner Costerisan, we specialize in helping cannabis businesses navigate complex tax and compliance changes while keeping an eye on long-term strategy. Our cannabis industry advisors work with operators to:

- Run detailed tax impact forecasts

- Identify cost-saving opportunities

- Build board-ready reports and financial insights

- Ensure compliance while supporting growth

The new Michigan cannabis tax is a reminder that in this industry, change is constant. Success comes down to being proactive, strategic, and focused on your next move.

Register for the Webinar

Join Maner’s upcoming webinar, Michigan’s New Wholesale Marijuana Tax: Actionable Steps to Prepare Your Business Amidst Uncertainty, on Thursday, December 2, at 10 a.m. ET to learn more about how you can stay ahead of the new tax and ensure your compliance isn’t at risk. You’ll gain clarity on:

- How the wholesale tax will work and who ultimately pays

- How to register, file, and pay for the tax

- How to set up the tax to calculate on customer invoices

- Important dates to know, including due dates, filing frequencies, and the effective date of the tax

Register today and learn actionable steps to be proactive, strategic, and focused on the future.