News & Insights

2022 Deadlines and Important Dates for Plan Sponsors

January 20th, 2022

|

Audit

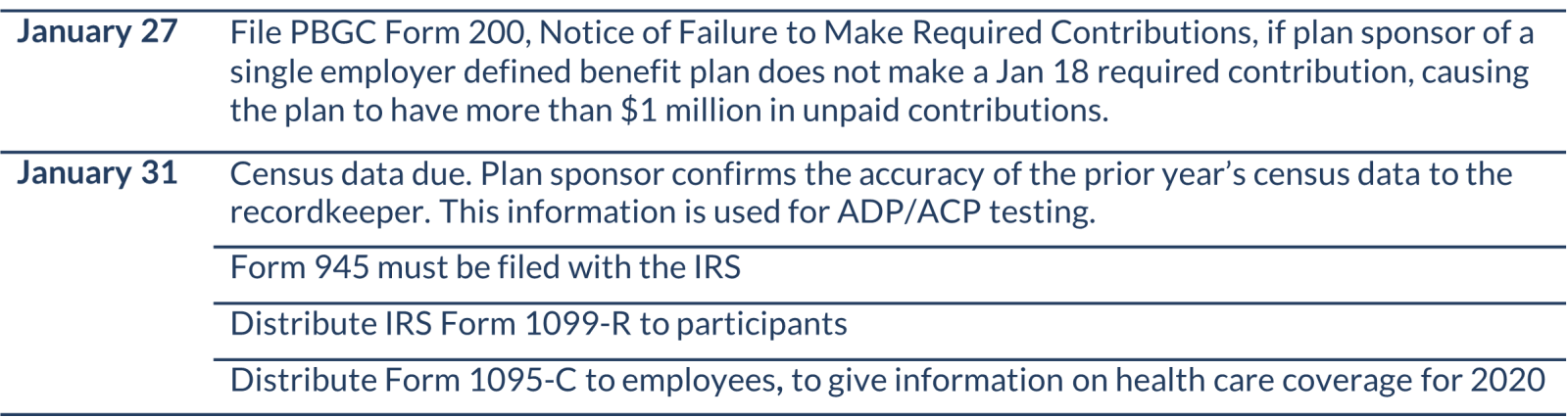

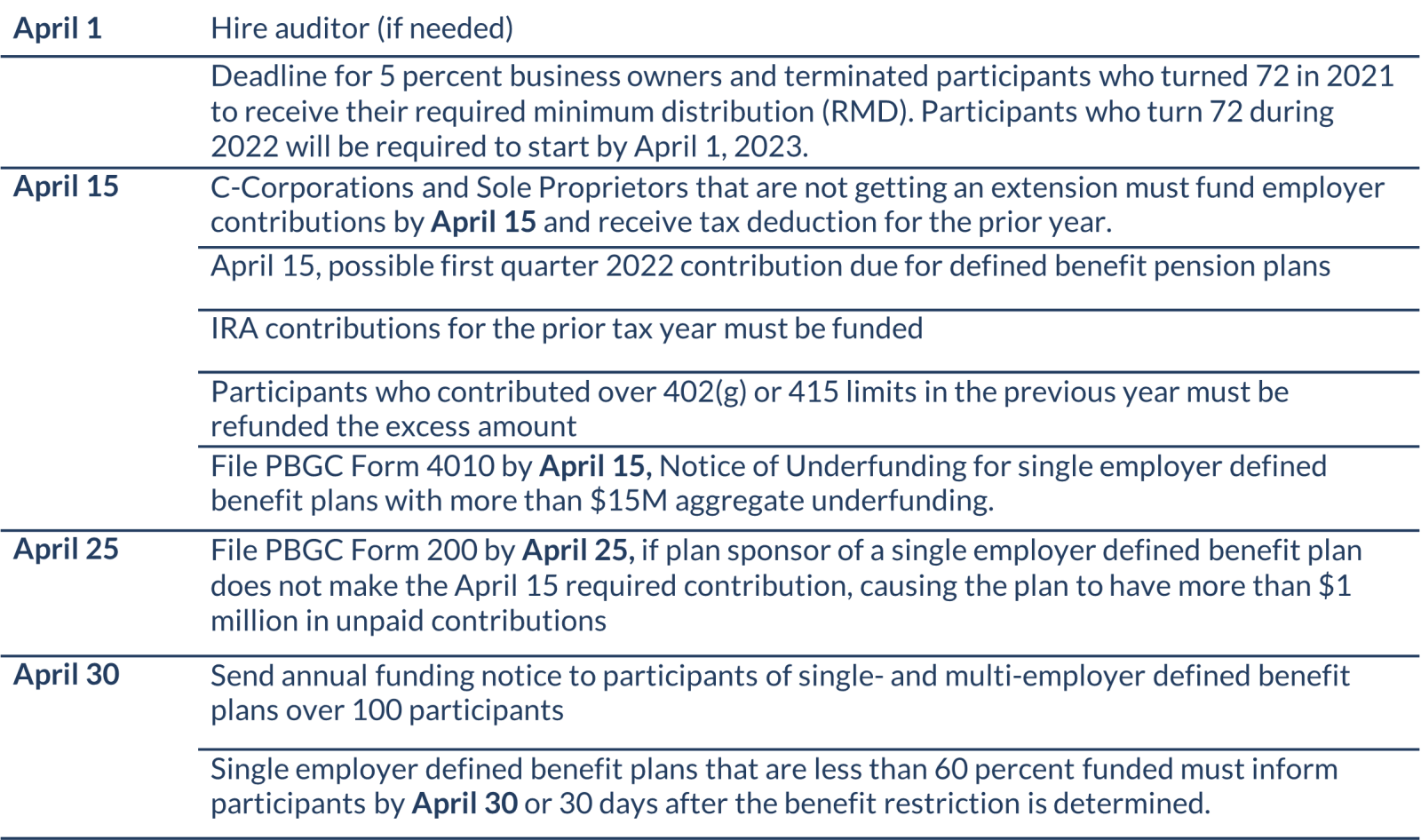

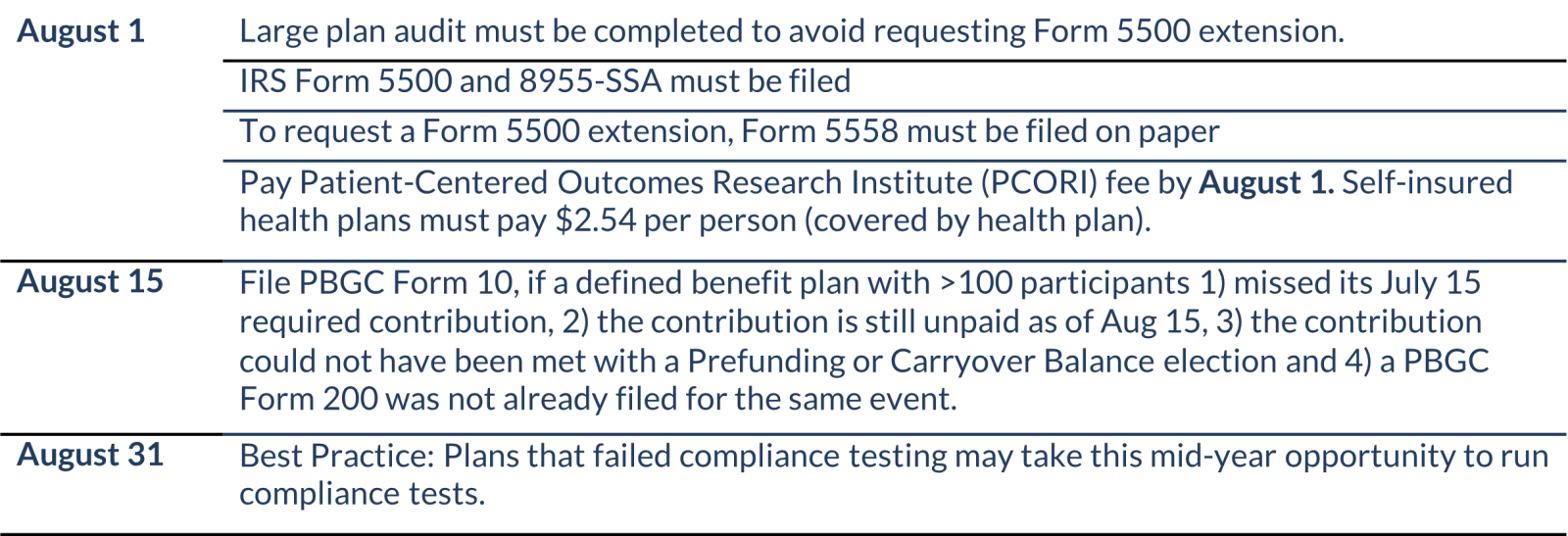

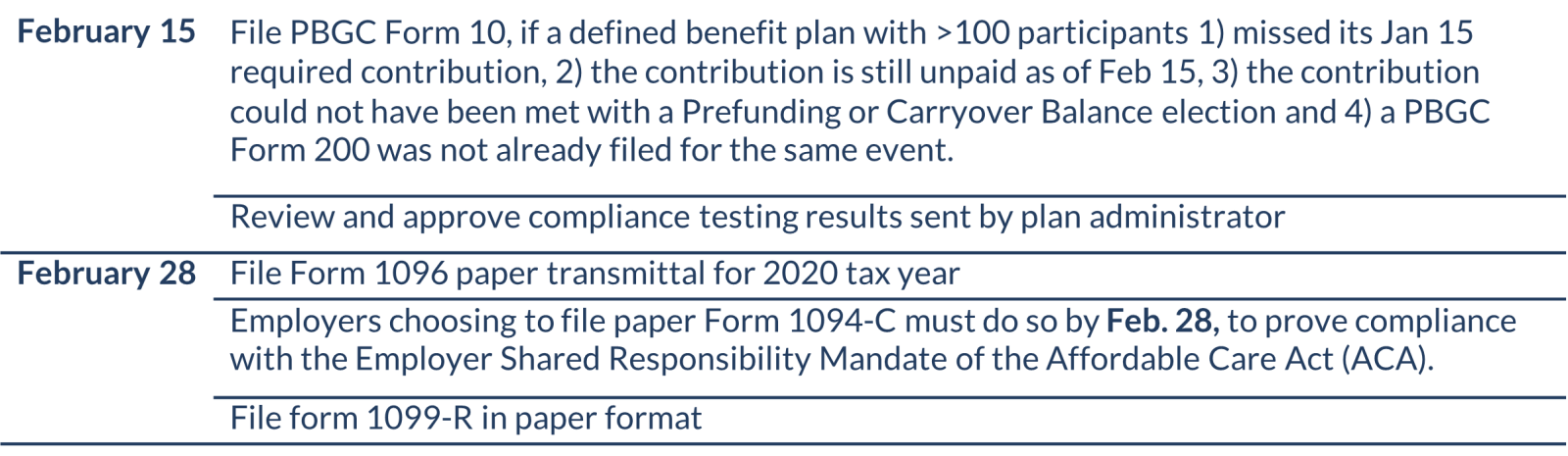

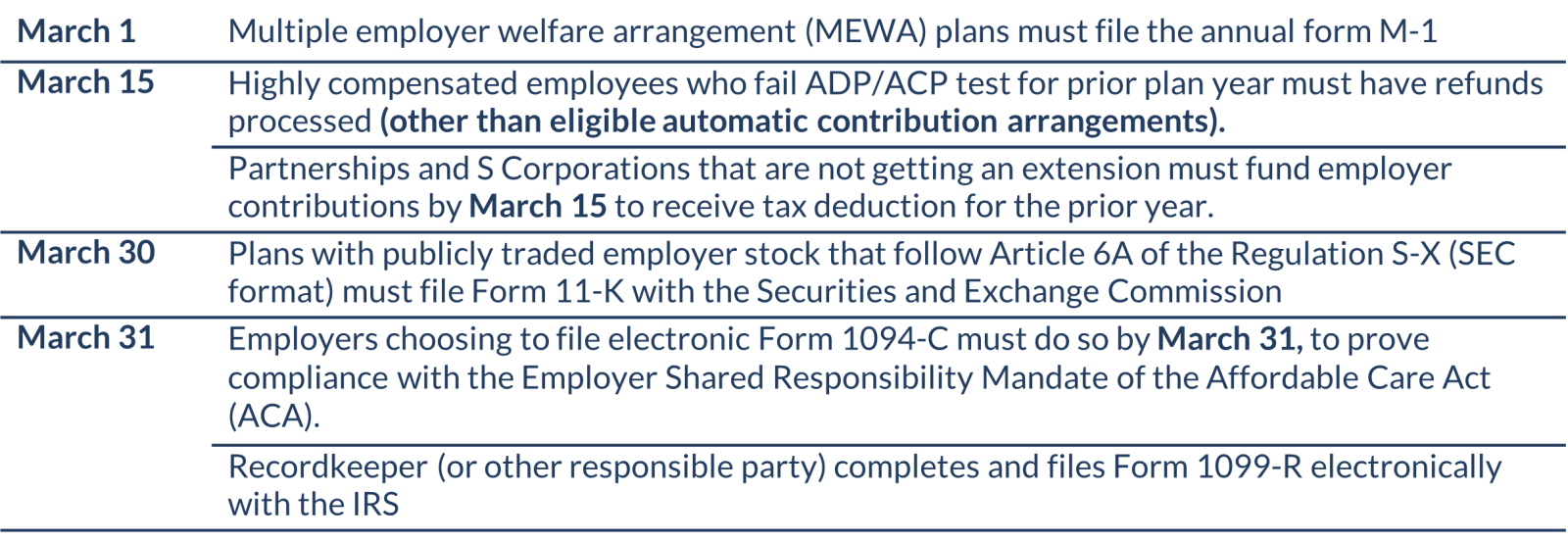

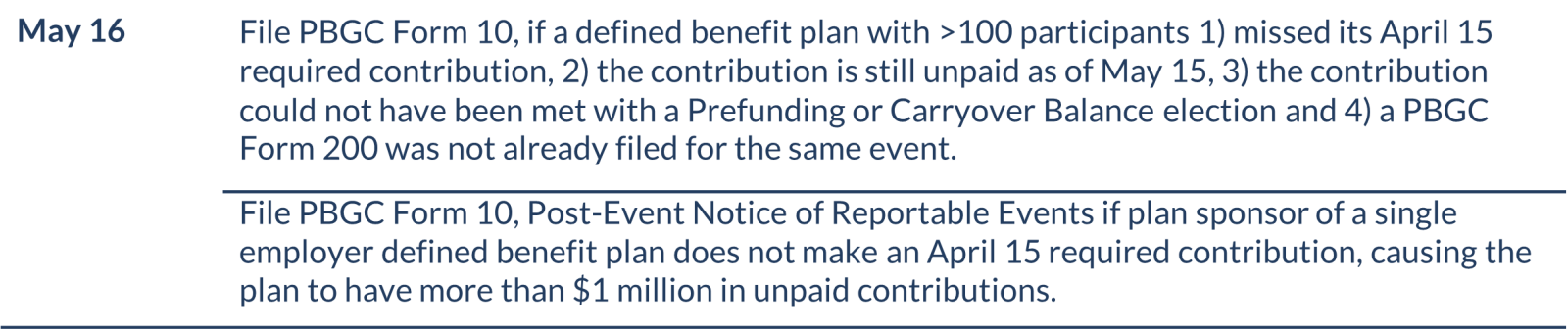

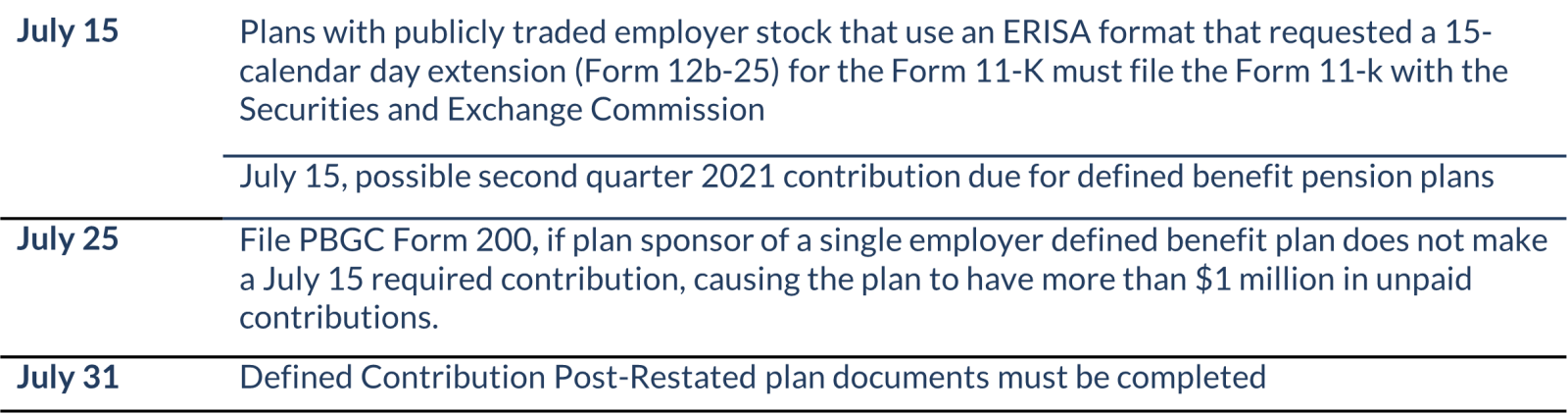

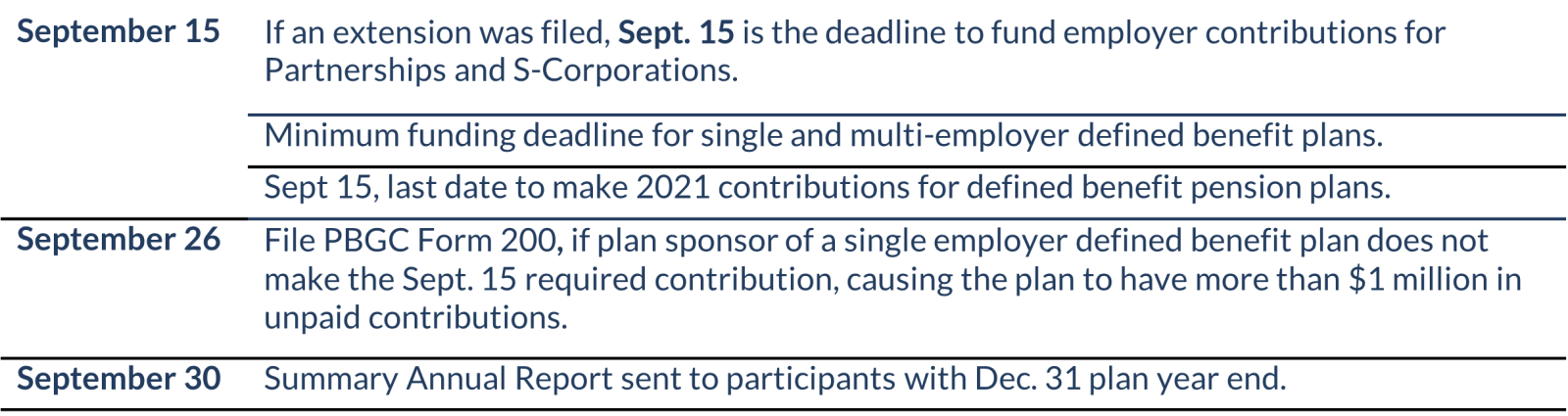

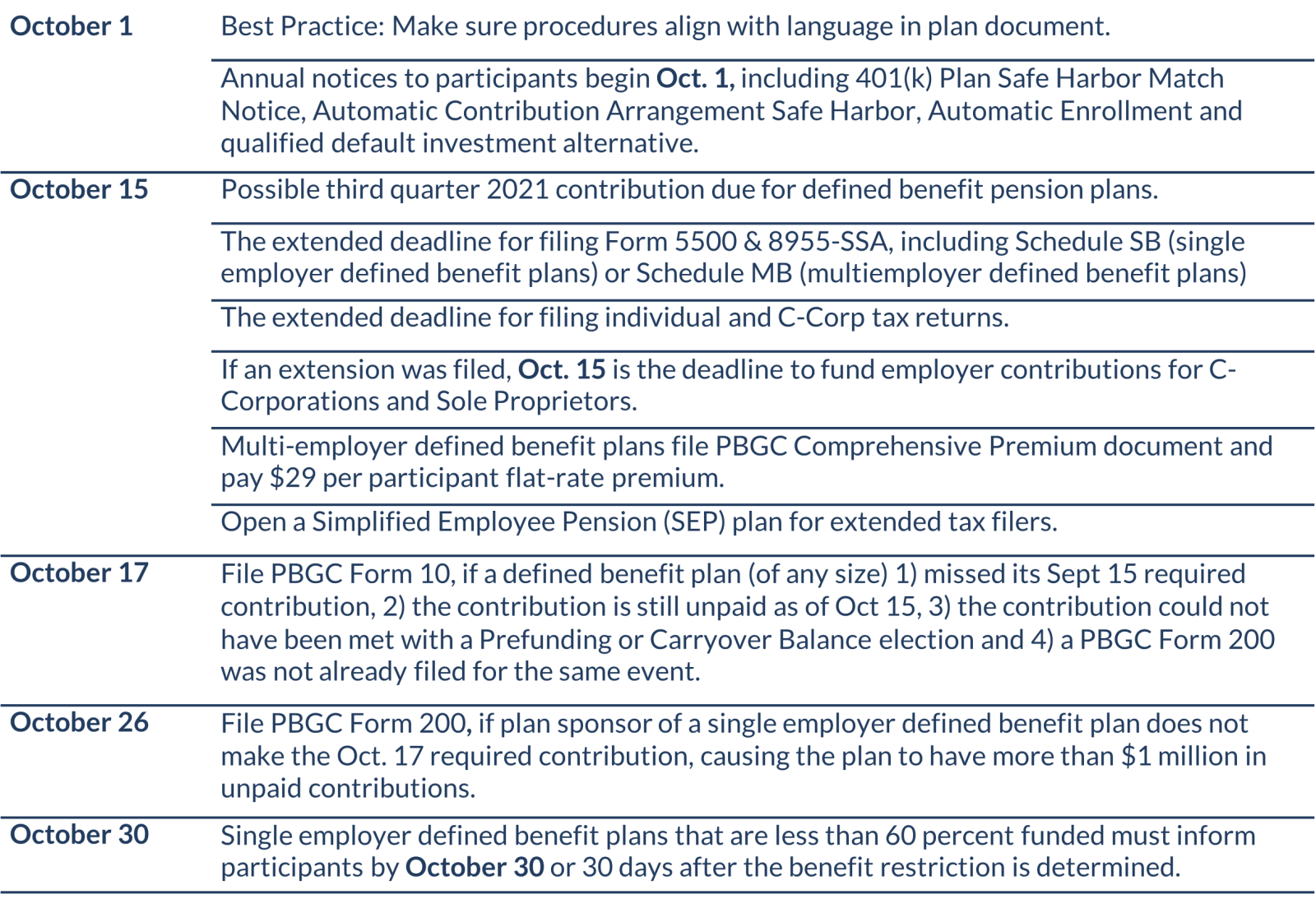

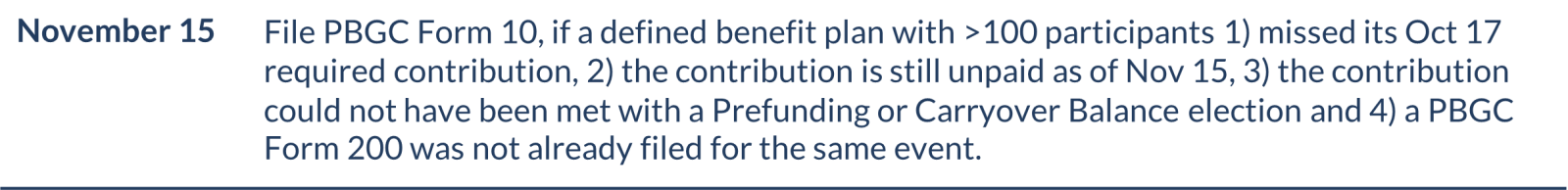

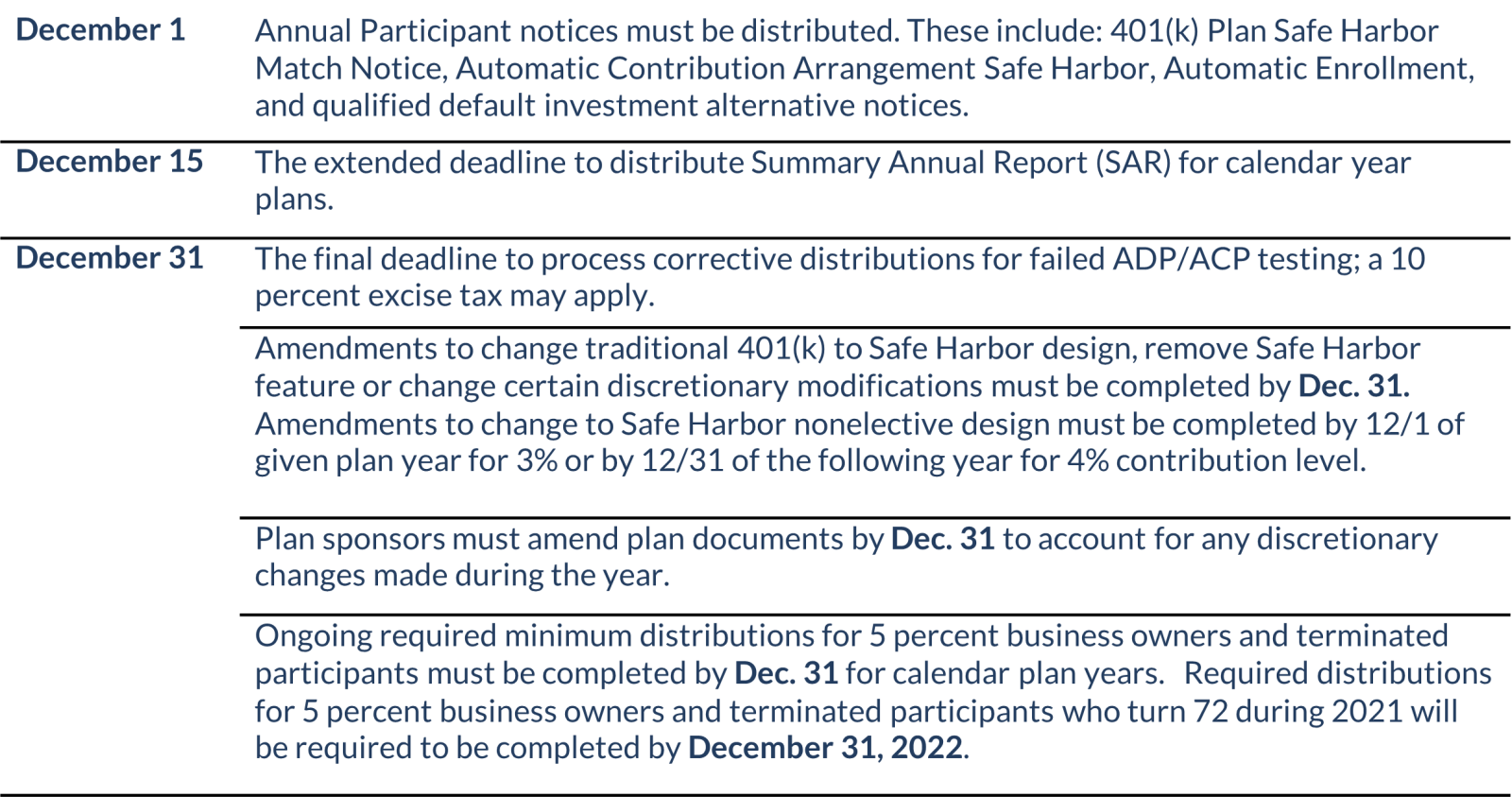

Sponsors of defined benefit and defined contribution plans should keep the following deadlines and other important dates in mind as they work toward ensuring compliance for their plans in 2022. Dates assume a calendar year plan. Some deadlines may not apply or may have dates shifted based on your organization’s fiscal year. For additional support, please contact Maner.

2022

Contribution Plan Limits and Other Rolling Notices for 2022

In addition to those important deadlines and dates, plan sponsors should be aware of the contribution plan limits and other rolling notices for 2022:

- Employee salary deferral limits for 401(k), 403(b) and 457 plans will be $20,500. Age 50 catch-up contribution limit remains at $6,500.

- Health Savings Account contribution limit is $3,650 (single) and $7,300 (family). Age 55 catch-up contribution stays at $1,000.

- Traditional and Roth Individual Retirement Account contribution limit will be $6,000. Catch-up contributions for participants age 50 and over is $1,000.

- Limitation for the annual benefit under a defined benefit plan under Section 415(b)(1)(A) will be $245,000.

- The dollar amount used to define “highly compensated employee” under Section 414(q)(1)(B) will be $135,000.

- Newly eligible employees must receive a Summary Plan Description (SPD) within 90 days after becoming covered by the plan.

- Provide quarterly statements and fee information to participants.

It’s a lot to follow, but we have you covered. The Employee Benefit Plan team at Maner Costerisan is available to help with all issues related to your plan. If you have questions or could use some expert insight on what steps to take next, we are here to help.

© 2022 BDO USA, LLP. All rights reserved. www.bdo.com