News & Insights

The Impact of Forward Guidance on Stocks

February 1st, 2022

|

By Michael Nordmann |

Financial & Retirement Planning |

High Net Worth |

Wealth Management

The investment markets have evolved quickly since the beginning of the year, which seems to be led by inflation pressuring savings, wages, and the broader economy. As a result, the economy appears eager to return to a place of normalization where interest rates turn higher and investors aren’t willing to pay as much for corporate earnings. How does an investor seek clarity in uncertain times? First, we can look to the past for future guidance. Second, we would do well to avoid overreacting to our own behavioral biases. Let’s start by learning from two recent experiences in which the Fed began to tighten the money supply growth.

Learning From 2015

The last time the Fed began to tighten was in 2015 under the leadership of Ben Bernanke. Over the next few years, the Federal Reserve toggled back and forth on rate hikes and rate cuts. By 2017, the money supply’s growth rate had finally begun to slow. As usual, through the Fed’s transparency, capital markets knew well in advance how new money flows would slow and how competition for capital would increase as a result.

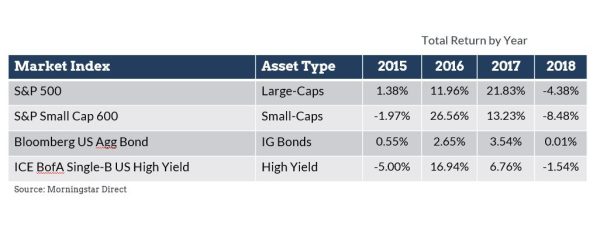

Investment markets were weak in 2015 on the anticipation that fresh rounds of new money would soon dry up as the Federal Reserve guided the economy towards a period of financial tightening. Money generally tightens as fewer deposits enter the banking system and as fewer loans are made available. Specifically, capital markets that depend on loans and other methods for raising capital underperformed in 2015. But investment markets performed nicely after that as the Federal Reserve went back and forth on rate policy decisions. In addition, 2017 was a significant job and tax cut year.

Learning From 2018

It wasn’t until 2018 that money flow deceleration mattered again. 2018 was when the Federal Reserve was letting assets taper from the central bank’s balance sheet (by reducing purchases of new bonds). That action alone slowed loan creation down in the banking system. However, we were never able to experience how the story would end because the Federal Reserve quickly reversed its decision to tighten with later rate cuts, and the pandemic unfolded shortly thereafter.

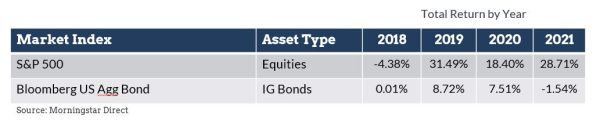

Equities indeed fell in 2018 when the Federal Reserve intentionally slowed the annual money supply growth, but equities performed incredibly well in the few years that followed. Average returns posted to many of the broad equity indexes reached double-digit gains, and average returns in investment-grade (IG) bonds have not disappointed either. Bonds received back-to-back wins in 2019 and 2020 when economic policy buried interest rates to allow aggressive spending using government deficits.

The pandemic and resulting economic policy shaped the investing environment that we are now experiencing, which compounded equity returns by the end of 2020 and throughout 2021. Of course, some type of monetary and fiscal response to the pandemic was essential for the economy and financial markets. Otherwise, the economic damage may have been catastrophic. We could have experienced far more business failures and depression-like unemployment without any stimulus hitting the banking system. Additionally, government transfer payments gave new hope to many in need. With that said, it isn’t entirely clear how equity returns would have fared in 2020 and 2021 without the pandemic and associated Fed response. Regardless, 2019 proved to generate sizeable returns to equity investors after the volatility experienced in 2018.

Current Monetary Policy Key Takeaways

The pandemic was the catalyst for an unprecedented money creation environment as government deficits poured trillions of dollars in as new loans. As a result, capital market growth compounded worldwide. But things can’t stay this way forever. Newton’s third law, “For every action, there is an equal and opposite reaction,” can also apply in economic systems, with inflation acting as the great moderator. Unexpected results began to occur, such as the massive shift to consuming physical goods and the stress it has caused on supply chains. In addition, the last two years were excellent times for venture. With so much money moving around, new investments rarely saw a shortage of new investors. Therefore, the time has come for policymakers and monetary authorities to tap on the brakes following another prolonged period of significant money supply growth. 2022 will likely be marked as the year interest rates rose, and the valuations normalized on sales, earnings, and other fundamental metrics. However, this shift in monetary policy does not have to spell trouble for the economy’s overall health.

- 2015 and 2018 reminded us of how the Fed uses its forward guidance to transparently prepare the markets and economy. The years in which the Fed begins communicating its future intentions can often result in volatility as the markets digest the Fed’s evolving strategy. Volatility is necessary for the markets but, again, in the prior recent examples of Fed tightening, the years following resulted in attractive market returns.

- Investment returns are driven by supply and demand and, as demand shifts, investment returns are impacted. Although the recent Federal Reserve guidance has introduced certain anticipation in the equity markets, it is important to consider where investors will go next in an effort to understand potential future severity or duration of the equity market volatility. Other than stocks, bonds are the major asset classes that could attract asset flows from equity investors. The bond markets are currently in a rather unattractive state for most investors, as the environment is currently characterized by low interest rates, likely rising interest rates, and potentially rising inflation. As a result, it doesn’t appear that asset flows will shift to bonds out of stocks, which would otherwise pose the risk of a sustained equity market pull back.

- As the Fed begins guiding for change, tightening the purse strings is likely the right thing to do, now that millions of new jobs exceed workers and the prices we pay for food and energy are significantly higher. Even the investment cost to earn interest and forward earnings have been driven up dramatically, which brought down future capital rates. In other words, there is a lot more money chasing a finite stock of physical capital and resources, so the Federal Reserve must start to regulate before inflation moves too high. The hopeful result is improved strength of the broader economy. But, of course, uncertainty exists as Fed policy can overshoot and produce unintended consequences.

- For the long-term investor, much of the recent Fed action and market volatility boils down to short-term noise. Investments will rerate as part of a normal process that stays in constant motion. Still, capital markets have shown incredible benefits to the wise and patient investor over long investment cycles. Investors have benefited from the interest and productivity growth that the economy has received for a very long time in history. Finally, it seems likely that corporate profits will continue to grow and institutional companies will still have the cash to service their debt and pay dividends.

Commitment to Investment Philosophy

From a portfolio management perspective, it is important to remain invested in quality asset classes that are believed to add long-term value. We believe prudent risk management, proactive rebalancing strategies, and disciplined investment conviction are necessary in times of market stress. Our Investment Team is closely monitoring the evolving market and economic landscapes and will continually make portfolio adjustments as necessary, but in a manner that is anchored by our diligent investment principles and processes. Specifically, we are committed to our conviction of extensive diversification, with the goal of delivering prudent risk management and sustainable portfolio return. We feel it is important to remove our investors from knee-jerk reactions to market stress that can otherwise lead to permanent portfolio losses, which seemed to have occurred far too often for certain investors during the market losses of early 2020. This is why we feel that 2022 is not the year to give up on equities, alternative investments, and even those non-traditional bond-related investments, such as high-yields, bank loans, and hybrid securities. Rather, it is critical that we focus on the proper investment approach and remain committed to investment behavior that has historically provided attractive long-term investment outcomes.